Corporate governance | From the president to investors

as of July 2, 2020

Fundamental stance

PC DEPOT is currently striving to strengthen corporate governance to maintain transparent, healthy, and fair management by strengthening the supervisory function of the board of directors while promoting speedy management.

To achieve it, we emphasize the importance of securing transparency of management by disclosing appropriate information at appropriate timings as well as strengthening the management environment. We will continuously review our corporate governance system and enhance corporate values.

Reasons for not adhering to every principle of the Corporate Governance Code

Supplement to principle 4-1-3 : Plan for a successor to the Chief Executive Officer etc.

Our company will the procedure for selection and decision of a successor to the President.

Supplementary Principle 4-3-2: CEO election complying with an objective and transparent procedure

The Company is currently in the process of considering the procedure for CEO election.

Supplementary Principle 4-3-3: Establishment of an objective, timely and transparent procedure for CEO dismissal

The Company is currently also in the process of considering the procedure for CEO dismissal.

Disclosure based on each principle of the Corporate Governance Code

We have updated the following items:

• Supplement to principle 4-11-3: Analysis and assessment of the effectiveness of the Board of Directors as a whole

Added "III Corresponding measures taken in the term ended March 2020"

Principle 1-4: Strategically held shares

- (1) Policy on strategic holding

- The Company has a policy of refraining from holding any unnecessary assets, in principle. We do not hold any strategically held shares, in principle, with the exception of cases where doing so is deemed to maintain or develop a collaboration or transactional relationship that is strategically important with the aim of delivering improved corporate value.

- (2) Verification of strategically held shares

- The Company currently does not hold any strategically held shares. If intending to do so in the future, we will comprehensively verify the significance of holding such shares and the financial rationality doing so as well as whether it will contribute to improving the organization's corporate value. In the event of holding any strategically held shares, we will periodically consider the rationality of doing so and the option of reducing such holdings.

- (3) Standard for exercising voting rights on strategically held shares

- While respecting the business policy of the enterprise concerned, we make a comprehensive judgment about the exercise of voting rights by checking on a proposal-by-proposal basis whether the exercise will contribute to improving the Company's enterprise value in the medium and long term.

Principle 1-7 : Related party transactions

In our company, transactions between related parties (e.g. competitive transactions by directors, transactions between director and company, etc.) are subject to discussion and resolution by the Board of Directors. The Board of Directors Rules stipulate that directors who have a special interest in the resolution may not participate in the vote. Once a year, we confirm in writing the existence of the related-party transactions, including those made by the directors of our company and our subsidiaries.

Principle 2-6: Fulfillment of function as a corporate pension asset owner

The Company has no corporate pension fund system in place.

* The Company has in place a corporate defined contribution pension system in order to allow employees to build assets steadily.

Principle 3-1 : Enhancing disclosure of information

- (1) Management philosophy, business strategy and business plan

- Our management philosophy, management policy and medium- to long-term business strategy are available on our website (http://www.pcdepot.co.jp/co_ir/)

- (2) Basic concept and policy concerning Corporate Governance

- This item is described in item "1. Basic concept" of this report.

- (3) Policy and procedure when determining the compensation for management and directors

-

Our company discloses the total maximum amount and the total payment amount of compensation for directors in our business report and annual securities report, but not the amount for each director.

In deciding the compensation for each director, the Appointment and Compensation Committee, a voluntary advisory body to the Board of Directors, deliberates on matters concerning policies related to the determination of the compensation and calculation method thereof, taking into overall consideration the achievements of each director in the previous year, the business results of the division of which he/she is in charge, and the contribution to our company. Going forward, the compensation shall be determined after deliberation and consultation with the committee. - (4) Policy and procedure when electing management and nominating candidates for directors

- In our company, employees with good business results and the appropriate experience are elected or nominated as management or candidates for directors from the viewpoint of business continuity. Independent outside directors are elected from individuals with high levels of expertise and extensive experience who are capable of expressing opinions on such issues as growth strategy and a highly effective supervisory function from a standpoint independent of the management in order to improve the company's governance.

Regarding the candidates for outside auditors, we select multiple persons with professional expertise in law, accounting and risk management.

Following deliberations by the Audit Committee, decisions are made by the Board of Directors and referred for discussion and resolution at the General Shareholders' Meeting based on the said policy.

The removal of directors and corporate auditors shall be decided by the Board of Directors meetings attended by outside directors and referred for discussion and resolution at the General Shareholders' Meeting in case of any violation or suspected violation of any law, regulation or the Articles of Incorporation or if such removal is deemed reasonably appropriate.

In February 2019, our company established the Appointment and Compensation Committee as a voluntary advisory body to the Board of Directors. A majority of the committee members shall be outside directors.

Matters concerning policies related to the determination of compensation for directors or calculation method thereof shall be decided by the committee after deliberation and consultation. - (5) Explanation about each candidate when electing management and nominating candidates for directors

- The reasons why a person is nominated as a candidate for external director or external auditor have been given in our "Notice of Convocation of Ordinary General Shareholders' Meeting." They are also disclosed on our website. Please see the reference documents attached to the Notice of Convocation of the 24rd Ordinary General Shareholders' Meeting.

Supplement to principle 4-1-1 : Scope of management responsibility

The Board of Directors makes lawful and timely decisions on important matters such as the business plan and business strategy, so as to realize our sustainable growth and enhance our corporate value in the medium- to long-term. The matters to be resolved by the Board of Directors are specifically stipulated in the Board of Directors Rules. The scope of management responsibility is clearly stipulated in the Official Authority Rules.

Principle 4-9 : Standards of independence and capability required for external directors

In our company, an external director requires the following abilities in addition to the requirements of the Companies Act:

1. Ability to supervise and evaluate overall management through voting in the Board of Directors;

2. Ability to supervise conflicts of interest between our company and management, or between our company and an interested party other than management;

3. Ability to give useful advice regarding our corporate governance, based on experience and knowledge.

Moreover, we elect independent external directors who are not liable to cause any conflict of interest with a stockholder, in addition to meeting the requirements for independent officers determined by the Tokyo Stock Exchange.

Supplement to principle 4-11-1 : Approach on balance, diversity and number of members of the Board of Directors, and policy and procedure when electing directors

Our company decides the appropriate number of candidate directors for the scale of our business, taking into consideration at the same time the appropriate diversity of the members of the Board of Directors in terms such as age, sex and skills.

Supplement to principle 4-11-2 : Concurrent holding of positions by external officers

The concurrent holding of important positions by directors and auditors is described in the Notice of Convocation of the Ordinary General Shareholders' Meeting.

Supplement to principle 4-11-3 : Analysis and assessment of the effectiveness of the Board of Directors as a whole

The company will evaluate the general effectiveness of the Board of Directors, such as its role, function, size, structure, and management, and after deliberations at the board meeting, we will release a summary of the evaluation to the public and utilize it to enhance the functions of the board.

An overview of the evaluation of the Board of Directors’ effectiveness, carried out in 2017, is as follows.

I. Evaluation Framework and Method

a. Persons to Be Evaluated

All board members (9) and auditors (4) *Those serving as of March 2020

b. Execution Method

A questionnaire was distributed and collected (responses were anonymously collected)

c. Evaluation Criteria

i. Role and functions of the board

ii. Size and structure of the board

iii. Management of the board

iv. Coordination with auditing organizations

v. Relationships with external board members

vi. Relationships with shareholders and investors

d. Evaluation Process

Based on the results and entries of the collected questionnaire, we deliberated the outcome of the evaluation at a meeting of the Board of Directors.

II. Outline of evaluation results

Based on discussions held in the Board of Directors' meeting, it was confirmed that, in general, the Board of Directors' meetings had been operated in an effective manner.

In addition, in order to recognize the following three points as being issues and to strengthen the effectiveness of the Board of Directors' meetings further, we shall consult with the Nomination and Compensation Committee and make improvements.

1. Make a succession plan for the CEO and others

2. Enhance the training program for officers

3. Operate and manage the Board of Directors' meetings

Supplement to principle 4-14-2 : Policy for training of directors and auditors

When employees assume the posts of executive officer and director or auditors, our company thoroughly notifies them again of their responsibilities and duties based on the main relevant laws, including the Companies Act etc. Moreover, we thoroughly notify each external director and each external auditor of our corporate philosophy and the contents of our group's business.

Principle 5-1: Policy on constructive dialogue with shareholders

In order to realize our sustainable growth and enhance our corporate value in the medium- to long-term, our company maintains constructive dialogue with investors through briefings on earnings and individual interviews, and discloses the necessary information on our website, etc. as needed.

The President and Chief Executive Officer and the Director and General Manager of the General Stakeholder Relations Office hold dialogue with investors based on reports from the relevant department(s), taking into consideration the purpose and consequences of the dialogue as well as the attributes of the shareholders.

As the department in charge, the IR/SR Section of the General Stakeholder Relation Office appropriately exchanges information in cooperation with the relevant departments, and appropriately conducts information management such as establishing a silent period based on the Insider Transactions Management Rules.

The Board of Directors considers the approach in the next quarter after receiving the quarterly report on the dialogue with investors from the department in charge.

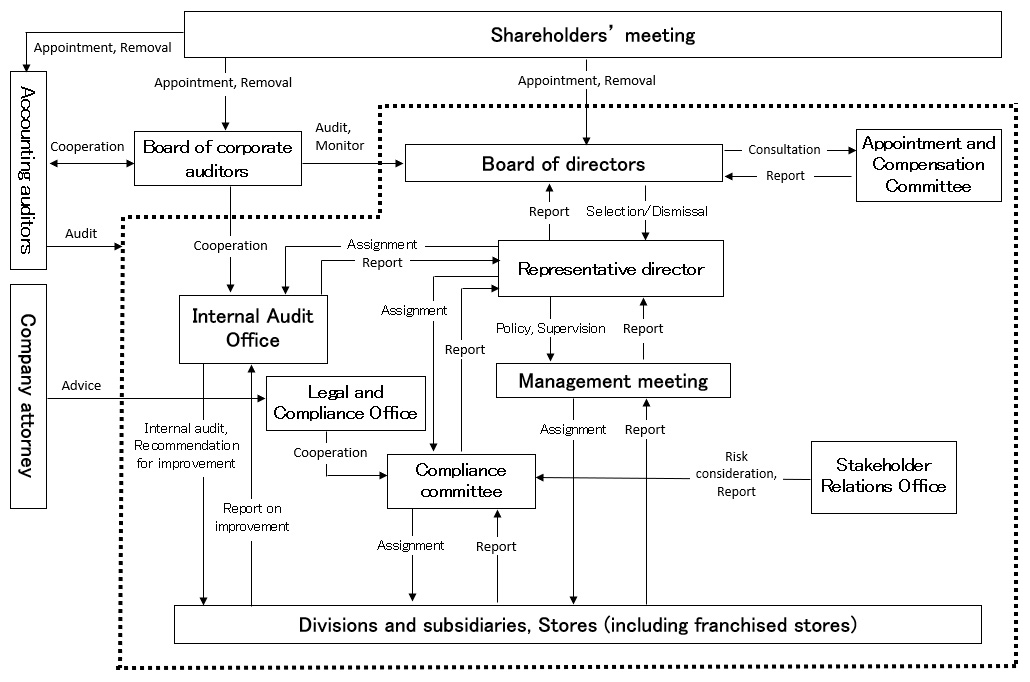

Matters concerning the functions related to business administration, audit/supervision, appointments, decision making on remuneration, etc. (outline of the current corporate governance system)

1.Outline of the corporate governance structure

PC DEPOT uses the corporate auditor system, and we invite outside directors and outside corporate auditors to assure the establishment of an objective management control system.

As of June 30, 2020, we had eight directors (including three outside directors) and four corporate auditors (including three outside auditors).

Outside corporate auditors were elected in order to strengthen management while at the same time assuring its continuing soundness.

2. Organizations of the Company

- <The Board of Directors>

-

In principle, regular Board of Directors' meetings are held monthly and extraordinary meetings are held as needed, and regarding the executions of duties based on resolutions by the Board of Directors, each director's responsibility and execution are determined by the Rules for Segregation of Duties and other rules. The Board of Directors consists of eight members: Representative Director, President & CEO Takahisa Nojima (chairman); Director & Senior Executive Officer Hideki Saitoh; Director & Executive Officers Kazuya Shinozaki, Yuko Matsuo, and Kazuyuki Sugiura (newly appointed); and Outside Directors Mineo Fukuda, Hidetaka Fukuda, and Yumiko Masuda. In addition, the structure is as such that the auditors—Corporate Auditor Koji Suzuki and Outside Auditors Masaki Nishimura, Yoshinari Noguchi, and Satoshi Tamai (newly appointed)—attend the meetings and supervise business operations executed by directors.

Further, in order to strengthen the structure in which the enhancement of the monitoring and supervisory functions of management as well as appropriate and fair decision-making can be achieved, we have appointed outside directors since the 15th Ordinary General Meeting of Shareholders held on June 18, 2009, and currently, three out of our eight directors are outside directors.

Please note that the term of directors is one year because they monitor decisions made on important matters and the performance of each director, and also because responsibilities in executing duties are to be clarified. - <The Board of Corporate Auditors>

-

The Company employs a Board of Corporate Auditors System, and determines audit policies and plans in accordance with laws and regulations as well as the articles of incorporation. The Board of Corporate Auditors consists of one full-time corporate auditor, Koji Suzuki (chairman), and three part-time outside auditors, Masaki Nishimura, Yoshinari Noguchi, and Satoshi Tamai (newly appointed).

Auditors attend the Board of Directors' meetings and mainly a full-time corporate auditor attends other important meetings including management meetings. By doing so, not only do auditors monitor directors' performance, but they also do research on properties and confirm the legality of the whole company's business execution in cooperation with the Internal Audit Office and our accounting auditor. - <Management meetings>

- In order to accelerate decision-making, management meetings are held as needed and important decisions are made after sharing information based on reports from related departments and having sufficient discussions. The meetings are chaired by Representative Director, President & CEO Takahisa Nojima, and consist of 12 members including Director & Senior Executive Officer Hideki Saitoh, Director & Executive Officers Kazuya Shinozaki, Yuko Matsuo, and Kazuyuki Sugiura (newly appointed), and Executive Officers Takayuki Shimano, Nobuyuki Tanaka, Junichi Ishihara, Daisuke Miyamoto, Hiroshi Saijyo, Keisuke Tomii, and Kazunari Higuchi (newly appointed).

- <The Compliance Committee>

- Regular Compliance Committee meetings are held monthly, where laws and regulations or risks reported are considered as needed and measures are taken in cooperation with the Compliance Office. The committee consists of four members in total—Executive Officer & Head of Compliance Office Nobuyuki Tanaka (chairman), Director & Executive Officers Yuko Matsuo and Kazuyuki Sugiura (newly appointed), and Director of a subsidiary Takashi Sawada.

- <The Nomination and Compensation Committee>

- "The Nomination and Compensation Committee," an advisory committee of the Board of Directors, consists of at least three directors, of which more than half of the members are outside directors, and it consists of five members—Outside Director and the committee chairman Mineo Fukuda, Representative Director, President & CEO Takahisa Nojima, Outside Directors Hidetaka Fukuda and Yumiko Masuda, and Full-time Corporate Auditor Koji Suzuki. By discussing directors' appointments and compensation, we make use of outside directors' expertise and advice and secure the objectivity and transparency of decision-making process for the appointment and compensation of directors, and at the same time, we improve the supervisory function of the Board of Directors, which will lead us to reinforce our corporate governance function further.

- <Executive officer system>

- We have introduced an executive officer system in order to clarify business execution and management responsibilities. It involves 12 members—Representative Director, President & CEO Takahisa Nojima, Director & Senior Executive Officer Hideki Saitoh, Director & Executive Officers Kazuya Shinozaki, Yuko Matsuo, and Kazuyuki Sugiura (newly appointed), and Executive Officers Takayuki Shimano, Nobuyuki Tanaka, Junichi Ishihara, Daisuke Miyamoto, Hiroshi Saijyo, Keisuke Tomii, and Kazunari Higuchi (newly appointed)—and plays a role to accelerate the execution of managerial decision-making and to report on the execution status.

- <Outside directors>

- With a structure in which three out of eight directors are outside directors, three out of four auditors are outside auditors, and five members are designated as independent directors among external directors, we strive to reinforce our corporate governance and to protect the interests of general shareholders.

3. Reinforcement of the audit function

■Auditor activities

Auditors attended the Board of Directors' meetings and monitored it to confirm that its management had been resolved and operated in accordance with laws and regulations as well as the articles of incorporation, and at the same time, they received reports on important management matters from directors and stated their opinions as appropriate. Also, in the Board of Corporate Auditors' meetings, they exchanged information and opinions with directors and executive officers on the situation of business execution and issues. Further, they held information exchange meetings with outside directors quarterly and exchanged opinions on governance. Please note that they cooperate closely with the accounting auditor by holding quarterly reviews, receiving reports on year-end audit situation and results, exchanging opinions on them, and exchanging information as appropriate throughout a fiscal year.

The full-time corporate auditor not only attended various important meetings and committee meetings, but also engaged in general auditing activities including reviewing important documents, performing audits at stores and year-end audits, and shared the contents with part-time auditors whenever needed. Full-time Corporate Auditor Koji Suzuki also makes proposals in the committee meetings as a member of the Nomination and Compensation Committee.

Part-time auditors performed audits and stated their opinions from a standpoint as independent outside directors through operations audits, corporate governance audits, and accounting audits, using each person's expertise and experience.

■Situation of internal audits

The Internal Audit Office (three staff members) and Internal Control Group (two staff members) are responsible for the Company's internal audit function and conduct internal audits based on the internal audit rules, which are part of the internal rules.

The Internal Audit Office systematically conducts audits of the headquarters' operations and stores, and reports the results to the CEO and auditors and notifies non-audit departments thereof, aiming for appropriate, better, and more efficient business operations and compliance with laws and regulations as well as the internal rules.

After exchanging opinions with the accounting auditor, the Internal Control Group prepares a risk control matrix based on the operation flows and descriptions of major businesses, conducts the audits of the operations, and engages in activities to increase their validity and efficiency.

In addition, the Internal Audit Office and Internal Control Group share information with the full-time corporate auditor on a daily basis and closely exchange opinions aiming to verify and improve the validity. While the database related to internal audits is readily viewed by the full-time corporate auditor at all times, they conduct audits through close and mutual cooperation.

4. Overview of content of limited liability contracts

Pursuant to the Companies Act Article 427 (1) and the provisions of the Articles of Incorporation, PC DEPOT has concluded contracts with directors (excluding executive directors, etc.) and corporate auditors to limit the liability of said directors and auditors specified under Article 423 (1) thereof. Under the contracts, the maximum amount of liability shall be limited to either an amount specified in advance (1 million yen or more for directors and 500,000 yen or more for corporate auditors) or the amount specified by laws and regulations, whichever is higher.

Reason for selecting the current corporate governance structure

The Company has adopted a corporate audit system where the Board of Corporate Auditors has auditing functions and three outside auditors monitor the appropriateness of business execution from a fair and unbiased standpoint, which increase management soundness. We have adopted this system as we judge that this system is effective for realizing and securing the Company's corporate governance and that it makes sound and fair management possible.

[Corporate Governance System]

Fundamental Approach to Internal Control Systems and Status of These Systems

1. Fundamental approach

When establishing internal control systems, PC DEPOT complies with its fundamental policy that prescribes guidelines for business activities. In addition, PC DEPOT conducts business activities that are legal and efficient, maintains the reliability of its financial statements, and has controls and procedures concerning the disclosure of corporate information. Risk is managed based on the periodic analysis of risk exposure.

PC DEPOT has an organizational stance that is resolutely opposed to anti-social forces.

2. Summary of Board of Directors resolutions concerning internal control systems

1. System to ensure that activities of the Company’s directors and employees comply with laws, regulations and the Articles of Incorporation

PC DEPOT has a rigorous program to ensure that directors and employees comply with laws, regulations, the Articles of Incorporation and other rules.

The Company is also upgrading its internal control system by reinforcing risk management systems and taking other actions.

At monthly meetings of the board of directors, the directors reaffirm their commitment to compliance to laws and regulations. Furthermore, directors, executive officers and employees sign a Compliance Oath every six months. This system makes these individuals reaffirm their commitments to compliance and business ethics. In addition, there are compliance training programs and tests.

PC DEPOT has appointed independent outside auditors in order to strengthen the management supervision function. For further activating the board of directors, the Company has decided to appoint independent outside directors.

PC DEPOT examines internal and external risks.

The Company organizes the "Risk Management Team" as necessary, which is made up primarily of internal/external officers.

The team ranks risks depending on the magnitude of their potential impact on the Company and their urgency and enacts preventive measures that match the level of each risk.

The Compliance Committee, which is made up primarily of directors, cooperates with the Risk Management Team to prevent problems from reoccurring.

2. System for storage and management of information concerning business execution by the Company’s directors

Documents (minutes of meetings, documents used for decision-making, contracts, etc.) and other information concerning how the directors perform their duties are properly stored and managed as prescribed by internal rules (rules of the board of directors, rules for handling decision-making documents, etc.).

3. Rules and other systems for management of risks that may cause losses to the Company

- a.Internal Audit/Internal Control Department

-

This department establishes and maintains/operates internal controls for the entire group, including subsidiaries, and oversees internal control functions across the entire group.

It also performs periodic audits of individual departments and on-site audits of stores. Periodic audit reports are sent to the representative director and corporate auditors after which departments and stores audited receive audit results and directives to take preventive measures.

Internal rules are constantly revised to reflect these reports to prevent the reoccurrence of problems. - b.Internal consultation contact, hot line and direct line to attorney

- These items create a framework with a self-cleansing mechanism backed by a system of checks and balances.

4. System to ensure that the Company’s directors perform their duties efficiently

At PC DEPOT, there is a regular meeting of the board of directors once each month, in principle. The directors reach decisions concerning important items and supervise the execution of business activities by the directors. In addition, the term of office for directors is one year in order to clarify their responsibilities regarding business activities.Moreover, for the performance of jobs that have been assigned to relevant directors by the board of directors, specific rules are determined for responsibilities and details of procedures for activities in each delegated business sector.

5. System to ensure proper activities at the Group, which includes PC DEPOT and its subsidiaries

- a. System for reporting to the Company regarding the performance of duties that have been assigned to relevant directors at subsidiaries

- PC DEPOT sends to its subsidiaries its officers, who report the status of the subsidiary’s business activities and performance of duties by its directors to the board of directors on a regular basis.

- b. Rules and other systems for management of risks that may cause losses at subsidiaries

- The Internal Audit/Internal Control Department establishes/operates internal controls for the entire group, including subsidiaries, by focusing on 42 control items at the group level.

In addition, the Department performs periodic on-site audits of subsidiaries.

Regular audit reports are submitted to the representative director and auditors, and after that, the divisions audited are notified of the results of the audits.

The Department receives from these divisions the reports on their preventive measures and the results of the measures taken. - c. System to ensure that the subsidiaries’ directors perform their duties efficiently

- While respecting the autonomy of subsidiaries, PC DEPOT ensures efficiency in the performance of their directors’ duties by receiving periodic reports on their business activities and having important matters discussed at the board meeting of the relevant subsidiaries after prior consultation.

- d. System to ensure that activities of subsidiaries’ directors and employees comply with laws, regulations and the articles of incorporation

- The Group strives to enhance its internal control systems by ensuring that the directors and employees comply with laws and regulations and the articles of incorporation and by strengthening its risk management system.

At monthly meetings of the board of directors of subsidiaries, the directors reaffirm their commitment to compliance to laws and regulations.

Furthermore, directors, executive officers and employees sign a Compliance Oath every six months.

This system has these individuals at subsidiaries reaffirm their commitment to compliance and business ethics.

In addition, there are compliance training programs and tests.

6. Matters concerning employees assigned to assist the Company’s auditors in performing their duties upon a request by an auditor

In response to a request from a corporate auditor, directors will assign employees to assist the corporate auditors in performing their duties.

7. Matters for ensuring the independence of employees specified in 6 from the Company’s directors and the effectiveness of directions given to the employees by corporate auditors

In order to ensure the independence of corporate auditors when performing their duties, employees who are assigned to assist them in performing their duties shall comply with the directions given to them by the auditors.

Said employees shall not receive orders and instructions from the director of the organization that they belong to.

8. System for reports to the Company’s auditors

- a. Directors and employees of the Company and its subsidiaries are required to provide reports and information that are requested by an auditor in the manner prescribed by the board of auditors.

- b.The reports and information in the above item contain primarily the following items.

- 1. The status of activities of departments associated with establishing internal control systems

- 2. The status of activities of corporate auditors and internal audit departments at subsidiaries and affiliates

- 3. Significant accounting policies and standards of PC DEPOT and any revisions

- 4. Announcements of business results and forecasts and the contents of other significant public announcements

- 5. Operations of the internal reporting system and the reports received

- 6. Submission of contracts, internal documents for decision-making and minutes of meetings as requested by a corporate auditor

9. System to ensure that those who provide reports prescribed in 8 shall not be treated adversely due to their reporting

PC DEPOT stipulates in its Compliance Committee Provisions that it is prohibited to treat adversely those who submit reports prescribed in 8 due to their reporting.

10. Policy on treatment of expenses incurred in connection with duties of auditors

PC DEPOT has a system in place for the smooth execution of procedures for advance payments or reimbursement of expenses incurred by corporate auditors in executing their duties and any other processing of expenses or reimbursement of costs they incur in connection with their duties, upon request from the auditors.

Fundamental Approach to Eliminating Anti-social Behavior and Status of Measures

1. Fundamental approach

To fulfill its social obligations and defend itself, PC DEPOT refuses any and all contact, improper demands and other actions of anti-social elements. PC DEPOT has an uncompromising stance regarding the refusal of any relationship with anti-social elements.

2. Status of internal systems

PC DEPOT's Legal Affairs and Compliance Office is responsible for overseeing internal systems for the elimination of anti-social forces.

Employees confirm their commitment to refusing any contact with anti-social elements in the Compliance Oath that they sign every six months.

When selecting suppliers and other business partners, PC DEPOT performs a survey when the relationship is first established and periodically thereafter as prescribed by PC DEPOT's rules. Contracts with business partners include a provision concerning the refusal to associate with anti-social elements.

These contracts include a clause that allows PC DEPOT to terminate the contract if a business partner that signed a contract is later found to have a business relationship with anti-social elements. This provides a means for the elimination of any relationships with anti-social elements.

3. Cooperation with external organizations

The Company is a member of the Kanagawa Prefecture Corporate Defensive Measures Council. This council works closely with the police, attorneys, external survey agencies and other organizations to exchange and gather information. To respond to problems involving anti-social elements, the council works closely with the police, attorneys and other external organizations to achieve a resolution quickly.